OXFORD, United Kingdom, Aug. 08, 2024 (GLOBE NEWSWIRE) -- Barinthus Biotherapeutics plc (NASDAQ: BRNS), a clinical-stage biopharmaceutical company developing novel T cell immunotherapeutic candidates, provided an overview of the Company’s progress and announced its financial results for the second quarter of 2024.

“Following the positive VTP-300 Phase 2 data in hepatitis B virus (HBV) in the second quarter, we made the strategic decision to prioritize our HBV and celiac disease programs. These two programs have the greatest probability for success and value creation, and represent significant opportunities in therapeutic areas with substantial unmet patient need,” said Bill Enright, Chief Executive Officer of Barinthus Bio. "We are very excited as we plan to initiate our first in human clinical trial of VTP-1000 in celiac disease in the third quarter, utilizing our novel SNAP-TI platform. Celiac disease is an increasingly common autoimmune disease with no FDA or EMA-approved treatments. Towards the end of the year we look forward to sharing updated data from our HBV program as our two Phase 2 trials utilizing VTP-300, which are evaluating a potential functional cure regimen, mature further."

Second Quarter 2024 and Recent Corporate Developments

Clinical developments: VTP-300 (HBV)

In June 2024, we announced updated data from two ongoing Phase 2 clinical trials in people with chronic hepatitis B (CHB) at the European Association for the Study of the Liver (EASL) Congress 2024. The presentations included updated interim data from the Phase 2b clinical trial (HBV003), as well as updated interim data from the Phase 2a clinical trial (IM-PROVE II, AB-729-202) in partnership with Arbutus Biopharma, both in people with CHB receiving ongoing standard of care nucleos(t)ide analogue (NUC) therapy.

Interim HBV003 data: VTP-300 and Low-dose Nivolumab

Interim data from the HBV003 trial showed;

Interim IM-PROVE II data: imdusiran and VTP-300

Interim data from the IM-PROVE II clinical trial showed;

Corporate Updates

Upcoming Milestones

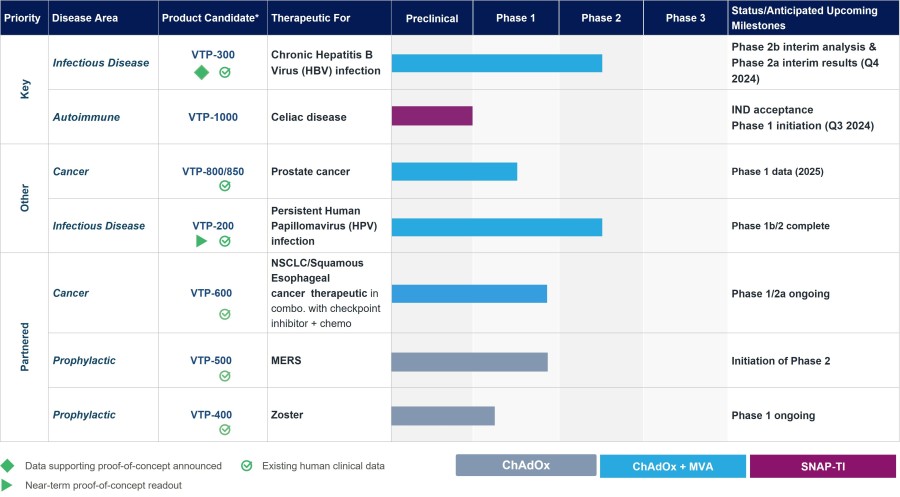

Pipeline

These are estimated timelines only and our pipeline may be subject to change.

These are estimated timelines only and our pipeline may be subject to change.

Second Quarter 2024 Financial Highlights

| Period ended | Three months ended June 30, 2024 | Three months ended March 31, 2024 | Change | |||||||

| $000 | $000 | $000 | ||||||||

| Direct research and development expenses by program: | ||||||||||

| VTP-200 HPV | $ | 383 | $ | 1,253 | $ | (870 | ) | |||

| VTP-300 HBV | 3,034 | 1,913 | 1,121 | |||||||

| VTP-500 MERS1 | 304 | 172 | 132 | |||||||

| VTP-600 NSCLC2 | 24 | 164 | (140 | ) | ||||||

| VTP-850 Prostate cancer | 414 | 178 | 236 | |||||||

| VTP-1000 Celiac | 1,371 | 1,374 | (3 | ) | ||||||

| Other and earlier stage programs | 908 | 784 | 124 | |||||||

| Total direct research and development expenses | $ | 6,438 | $ | 5,838 | $ | 600 | ||||

| Indirect research and development expenses: | ||||||||||

| Personnel-related (including share-based compensation) | 4,763 | 4,335 | 428 | |||||||

| Facility related | 342 | 390 | (48 | ) | ||||||

| Other indirect costs | 119 | 562 | (443 | ) | ||||||

| Total indirect research and development expenses | 5,224 | 5,287 | (63 | ) | ||||||

| Total research and development expense | $ | 11,662 | $ | 11,125 | $ | 537 | ||||

1 The development of VTP-500 is funded pursuant to an agreement with the Coalition for Epidemic Preparedness Innovations (CEPI).

2 The VTP-600 NSCLC Phase 1/2a trial is sponsored by Cancer Research UK.

About Barinthus Bio

Barinthus Bio is a clinical-stage biopharmaceutical company developing novel T cell immunotherapeutic candidates designed to guide the immune system to overcome chronic infectious diseases and autoimmunity. Helping people living with serious diseases and their families is the guiding principle at the heart of Barinthus Bio. With a focused pipeline built around our proprietary platform technologies, Barinthus Bio is advancing product candidates in infectious disease and autoimmunity, including: VTP-300, an immunotherapeutic candidate utilizing our ChAdOx/MVA platform designed as a potential component of a functional cure for chronic HBV infection and VTP-1000, an autoimmune candidate designed to utilize the SNAP-Tolerance Immunotherapy (TI) platform to treat patients with celiac disease. Barinthus Bio also has a Phase 1 clinical trial for VTP-850, a second-generation immunotherapeutic candidate designed to treat recurrent prostate cancer. Barinthus Bio’s proven scientific expertise, diverse portfolio and focus on pipeline development uniquely positions the company to navigate towards delivering treatments for people with infectious diseases and autoimmunity that have a significant impact on their everyday lives. For more information, visit www.barinthusbio.com.

Forward Looking Statements

This press release contains forward-looking statements regarding Barinthus Bio within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, which can generally be identified as such by use of the words “may,” “will,” “plan,” “forward,” “encouraging,” “believe,” “potential,” "expect", and similar expressions, although not all forward-looking statements contain these identifying words. These forward-looking statements include, without limitation, express or implied statements regarding our future expectations, plans and prospects, including our product development activities and clinical trials, including timing for readouts of any preliminary, interim or final data for any of our programs, the timing for initiation of any clinical trials, including dosing of the first patient in GLU001 for VTP-1000, our anticipated regulatory filings and approvals, our cash runway, and our ability to develop and advance our current and future product candidates and programs. Any forward-looking statements in this press release are based on our management’s current expectations and beliefs and are subject to numerous risks, uncertainties and important factors that may cause actual events or results to differ materially from those expressed or implied by any forward-looking statements contained in this press release, including, without limitation, risks and uncertainties related to the success, cost and timing of our pipeline development activities and planned and ongoing clinical trials, including the risk that the timing for preliminary, interim or final data or initiation of our clinical trials may be delayed, the risk that interim or topline data may not reflect final data or results, our ability to execute on our strategy, regulatory developments, the risk that we may not achieve the anticipated benefits of our pipeline prioritization and corporate restructuring, our ability to fund our operations and access capital, our cash runway, including the risk that our estimate of our cash runway may be incorrect, global economic uncertainty, including disruptions in the banking industry, the conflicts in Ukraine, Israel and Gaza, and other risks identified in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2023, our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. We caution you not to place undue reliance on any forward-looking statements, which speak only as of the date they are made. We expressly disclaim any obligation to publicly update or revise any such statements to reflect any change in expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements.

| BARINTHUS BIOTHERAPEUTICS PLC CONSOLIDATED BALANCE SHEETS (IN THOUSANDS, EXCEPT NUMBER OF SHARES AND PER SHARE AMOUNTS) (UNAUDITED) | |||||||

| June 30, 2024 | December 31, 2023 | ||||||

| ASSETS | |||||||

| Cash, cash equivalents and restricted cash | $ | 117,774 | $ | 142,090 | |||

| Research and development incentives receivable | 4,523 | 4,908 | |||||

| Prepaid expenses and other current assets | 9,582 | 9,907 | |||||

| Total current assets | 131,879 | 156,905 | |||||

| Goodwill | 12,209 | 12,209 | |||||

| Property and equipment, net | 10,962 | 11,821 | |||||

| Intangible assets, net | 23,527 | 25,108 | |||||

| Right of use assets, net | 7,286 | 7,581 | |||||

| Other assets | 886 | 882 | |||||

| Total assets | $ | 186,749 | $ | 214,506 | |||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

| Current liabilities: | |||||||

| Accounts payable | 2,556 | 1,601 | |||||

| Accrued expenses and other current liabilities | 10,278 | 9,212 | |||||

| Deferred income | 839 | — | |||||

| Operating lease liability - current | 1,916 | 1,785 | |||||

| Total current liabilities | 15,589 | 12,598 | |||||

| Non-current liabilities: | |||||||

| Operating lease liability - non-current | 10,654 | 11,191 | |||||

| Contingent consideration | 1,888 | 1,823 | |||||

| Other non-current liabilities | 1,338 | 1,325 | |||||

| Deferred tax liability, net | 490 | 574 | |||||

| Total liabilities | $ | 29,959 | $ | 27,511 | |||

| Commitments and contingencies (Note 15) | |||||||

| Stockholders’ equity: | |||||||

| Ordinary shares, £0.000025 nominal value; 39,184,338 shares authorized, issued and outstanding (December 31, 2023: authorized, issued and outstanding:38,643,540) | 1 | 1 | |||||

| Deferred A shares, £1 nominal value; 63,443 shares authorized, issued and outstanding (December 31, 2023: authorized, issued and outstanding:63,443) | 86 | 86 | |||||

| Additional paid-in capital | 390,273 | 386,602 | |||||

| Accumulated deficit | (209,010 | ) | (176,590 | ) | |||

| Accumulated other comprehensive loss – foreign currency translation adjustments | (24,732 | ) | (23,315 | ) | |||

| Total stockholders’ equity attributable to Barinthus Biotherapeutics plc shareholders | 156,618 | 186,784 | |||||

| Noncontrolling interest | 172 | 211 | |||||

| Total stockholders’ equity | $ | 156,790 | $ | 186,995 | |||

| Total liabilities and stockholders’ equity | $ | 186,749 | $ | 214,506 | |||

| BARINTHUS BIOTHERAPEUTICS PLC CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (IN THOUSANDS, EXCEPT NUMBER OF SHARES AND PER SHARE AMOUNTS) (UNAUDITED) | |||||||||||||||

| Three months ended | Six months ended | ||||||||||||||

| June 30, 2024 | June 30, 2023 | June 30, 2024 | June 30, 2023 | ||||||||||||

| License revenue 1 | $ | — | $ | 334 | $ | — | $ | 802 | |||||||

| Total revenue | — | 334 | — | 802 | |||||||||||

| Operating expenses | |||||||||||||||

| Research and development | 11,662 | 13,543 | 22,787 | 23,357 | |||||||||||

| General and administrative | 7,201 | 13,128 | 13,195 | 25,266 | |||||||||||

| Total operating expenses | 18,863 | 26,671 | 35,982 | 48,623 | |||||||||||

| Other operating income | 577 | — | 782 | — | |||||||||||

| Loss from operations | (18,286 | ) | (26,337 | ) | (35,200 | ) | (47,821 | ) | |||||||

| Other income/(expense): | |||||||||||||||

| Interest income | 635 | 522 | 1,410 | 2,110 | |||||||||||

| Interest expense | (12 | ) | (14 | ) | (24 | ) | (14 | ) | |||||||

| Research and development incentives | 693 | 559 | 1,287 | 1,716 | |||||||||||

| Other income | 20 | 310 | 20 | 310 | |||||||||||

| Total other income, net | 1,336 | 1,377 | 2,693 | 4,122 | |||||||||||

| Loss before income tax | (16,950 | ) | (24,960 | ) | (32,507 | ) | (43,699 | ) | |||||||

| Tax benefit | 7 | 1,136 | 44 | 1,652 | |||||||||||

| Net loss | (16,943 | ) | (23,824 | ) | (32,463 | ) | (42,047 | ) | |||||||

| Net loss attributable to noncontrolling interest | 12 | 22 | 43 | 65 | |||||||||||

| Net loss attributable to Barinthus Biotherapeutics plc shareholders | (16,931 | ) | (23,802 | ) | (32,420 | ) | (41,982 | ) | |||||||

| Weighted-average ordinary shares outstanding, basic | 39,041,111 | 38,407,672 | 38,907,296 | 38,211,625 | |||||||||||

| Weighted-average ordinary shares outstanding, diluted | 39,041,111 | 38,407,672 | 38,907,296 | 38,211,625 | |||||||||||

| Net loss per share attributable to ordinary shareholders, basic | $ | (0.43 | ) | $ | (0.62 | ) | $ | (0.83 | ) | $ | (1.10 | ) | |||

| Net loss per share attributable to ordinary shareholders, diluted | $ | (0.43 | ) | $ | (0.62 | ) | $ | (0.83 | ) | $ | (1.10 | ) | |||

| Net loss | $ | (16,943 | ) | $ | (23,824 | ) | $ | (32,463 | ) | $ | (42,047 | ) | |||

| Other comprehensive gain/(loss) – foreign currency translation adjustments | 164 | 5,604 | (1,413 | ) | 10,184 | ||||||||||

| Comprehensive loss | (16,779 | ) | (18,220 | ) | (33,876 | ) | (31,863 | ) | |||||||

| Comprehensive loss attributable to noncontrolling interest | 11 | 15 | 39 | 52 | |||||||||||

| Comprehensive loss attributable to Barinthus Biotherapeutics plc shareholders | $ | (16,768 | ) | $ | (18,205 | ) | $ | (33,837 | ) | $ | (31,811 | ) | |||

1 Includes license revenue from related parties for the three and six months ended June 30, 2024 of nil (three and six months ended June 30, 2023: $0.3 million and $0.8 million, respectively).

IR contacts:

Christopher M. Calabrese

Managing Director

LifeSci Advisors

+1 917-680-5608

This email address is being protected from spambots. You need JavaScript enabled to view it.

Kevin Gardner

Managing Director

LifeSci Advisors

+1 617-283-2856

This email address is being protected from spambots. You need JavaScript enabled to view it.

Media contact:

Audra Friis

Sam Brown, Inc.

+1 917-519-9577

This email address is being protected from spambots. You need JavaScript enabled to view it.

Company contact:

Jonothan Blackbourn

IR & PR Manager

Barinthus Bio

This email address is being protected from spambots. You need JavaScript enabled to view it.

| Last Trade: | US$0.72 |

| Daily Change: | -0.01 -1.56 |

| Daily Volume: | 38,872 |

| Market Cap: | US$29.400M |

December 10, 2025 November 07, 2025 September 30, 2025 August 07, 2025 June 09, 2025 | |

Chimerix is on a mission to develop medicines that meaningfully improve and extend the lives of patients facing deadly diseases. The company is devoted to filling gaps in the treatment paradigm. Chimerix’s most advanced clinical-stage program is in development for H3 K27M-mutant glioma....

CLICK TO LEARN MORE

Amneal Pharmaceuticals is a fully-integrated essential medicines company. We make healthy possible through the development, manufacturing, and distribution of generic and specialty pharmaceuticals. The Company has a diverse portfolio of over 250 products in its Generics segment and is expanding across...

CLICK TO LEARN MOREEnd of content

No more pages to load